Chapter 61 Information

What Is the Purpose of the Chapter 61 Programs?

Rising property values and taxes can make owning your land expensive. The Chapter 61 programs give Massachusetts landowners like you an opportunity to reduce your property taxes in exchange for providing important public benefits like clean water, wildlife habitat, rural character, wood products, food, and outdoor recreation.

Land that is not in a Chapter 61 program is assessed under Chapter 59 for its "highest and best use," which is considered to be its development value. When you choose to keep your land in Chapter 59, you may find yourself paying property taxes based on your land's development potential, even though your undeveloped land uses fewer town services, such as emergency services and schools, than developed land uses. Because undeveloped land provides valuable public benefits and requires fewer costly town services, the Chapter 61 programs offer a property tax break for landowners willing to commit to keeping some or all of their land undeveloped for a specified period of time.

The Chapter 61 programs can be helpful tools for keeping your land affordable and reaching your ownership goals. These programs can also help you as you plan for the long-term future of you land.

As with any decision about your land, the key to success is for you to carefully consider your options. This information about the Chapter 61 programs is intended to help you make an informed decision that is right for you and your family.

There are three different Chapter 61 programs:

All the programs aim to keep land undeveloped, and each program focuses on a different type of land use. You are allowed to change your enrollment from one Chapter 61 program to another without penalty, although to save time and effort, it is recommended that you choose the program that best fits your current and desired future land use, as well as your financial needs.

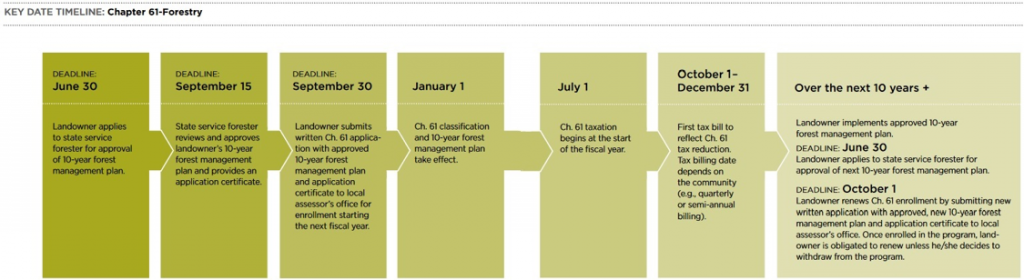

Chapter 61 - Forestry

Chapter 61 applies to land growing forest products, including wood, timber, Christmas trees, and other products produced by forest vegetation. Landowners receive a property tax reduction in exchange for a commitment to keep their land undeveloped and to manage it for forest products. Chapter 61 is a good fit for landowners interested in actively managing their forestland.

For additional information regarding the Chapter 61 program visit:

For information on MGL Chapter 61 visit:

To download a publication about the Chapter 61 program visit:

To contact your local DCR service forester visit:

To download the Chapter 61 application form visit:

To use the Chapter 61 Tax Calculator visit:

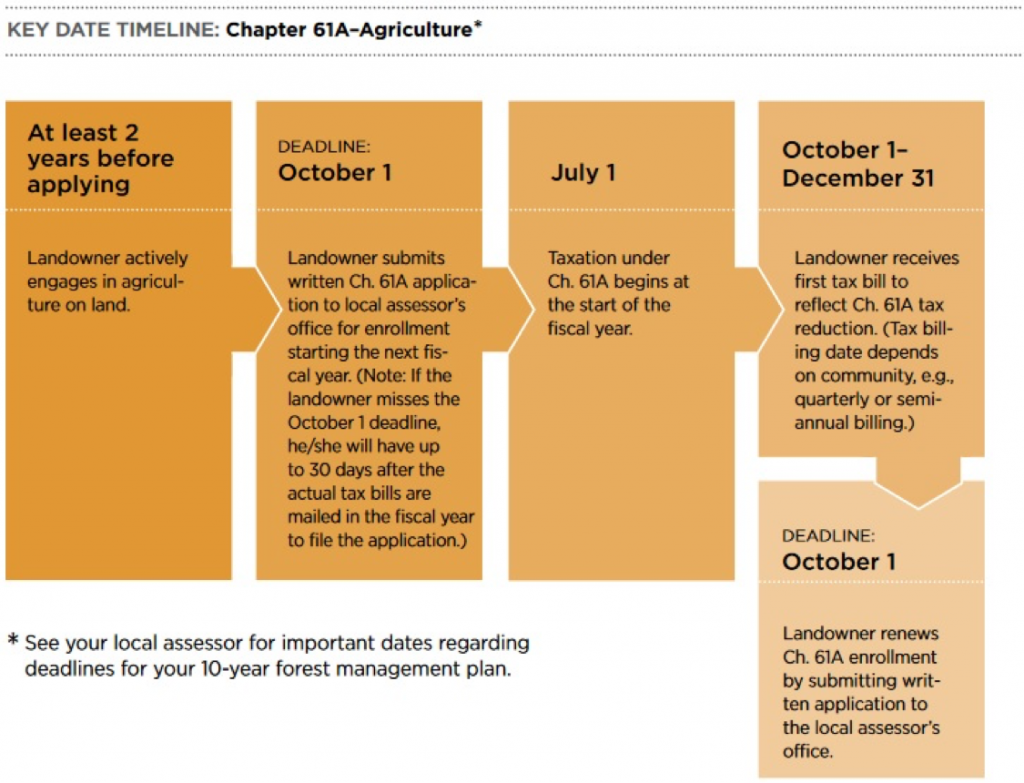

Chapter 61A - Agriculture

Chapter 61A is for land growing agricultural or horticultural products, including fruits, vegetables, ornamental shrubs, timber, animals, and maple syrup. Chapter 61A is a good fit for landowners engaged in agriculture on their land.

For additional information regarding the Chapter 61A program visit:

For information on MGL Chapter 61A visit:

To download a publication about the Chapter 61A program visit:

To contact your local DCR service forester visit:

To download the Chapter 61A application form visit:

To use the Chapter 61A Tax Calculator visit:

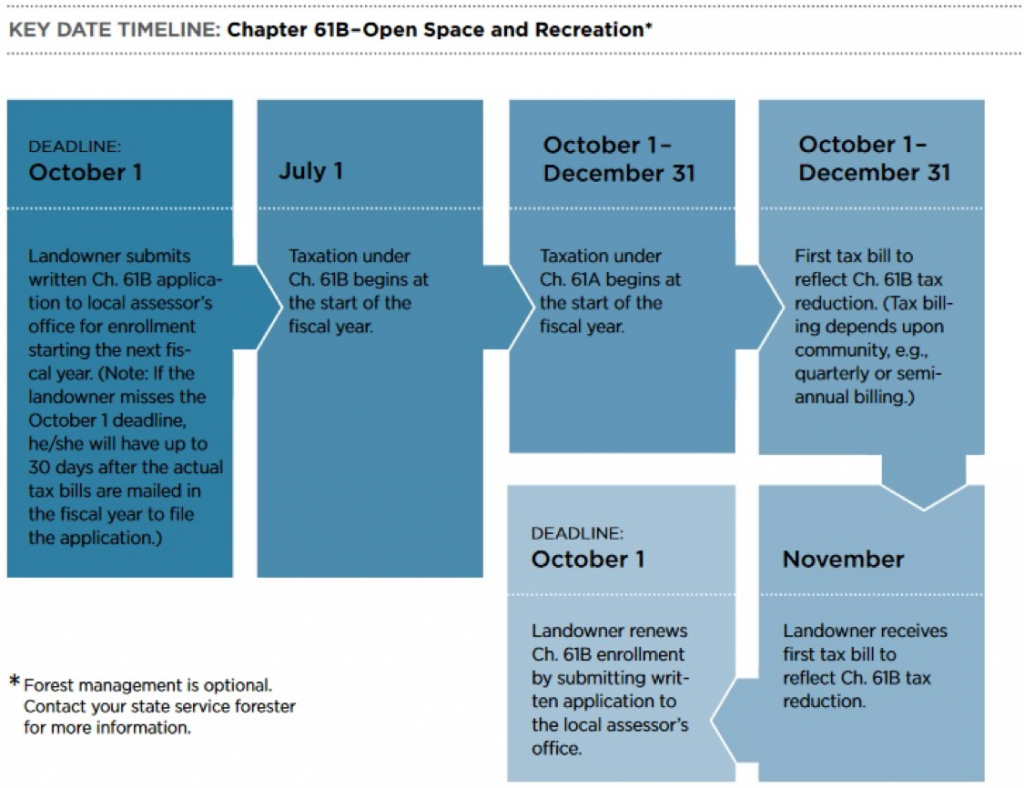

Chapter 61B - Open Space and Recreation

Chapter 61B is for land in open space and/or recreation. Because there is no requirement for land enrolled in Chapter 61B to be managed or have a 10-year forest management plan, the Chapter 61B program is a good fit for landowners who take a passive approach to their land.

For additional information regarding the Chapter 61B program visit:

For information on MGL Chapter 61B visit:

To download a publication about the Chapter 61B program visit:

To contact your local DCR service forester visit:

To download the Chapter 61B application form visit:

To use the Chapter 61B Tax Calculator visit: